If you're looking for the best travel insurance options, you've come to the right place. There are loads of comparison sites out there, but what sets us apart is that we know travel insurance better than anyone else. Travel insurance is all we do, and we do it well. It’s what we live and breathe. But, enough about us, let's talk about you.

How do I choose the best travel insurance?

So how do you get the best travel insurance for your trip? This is not as simply answered as you may think! When it comes to travel insurance, finding the best travel insurance for your holiday requires you to think about the type of trip you are going on and the level of cover you need. It's about matching your needs and budget to the various travel insurance policies in the market and weighing up the options.

The following tips will guide travellers to find the best travel insurance for their next adventure:

1. Determine the type and level of cover you need

There are different levels of cover available to suit all needs and budgets. Holidaymakers should look at the cover available and work out what they need cover for and what they don’t. There is no point paying top dollar for luggage cover, if you're only travelling with a backpack and fresh undies. The best travel insurance is one that covers you for your particular trip. Whether that's a once in a lifetime trip around-the-world or a domestic weekend break. There's no need to pay more for cover than your trip requires.

Overseas medical cover is considered the most essential component of travel insurance. Medical expenses can be eye-watering when the government isn't fitting the bill, but thankfully, medical cover is standard in most basic travel insurance policies. A basic policy will usually include overseas medical expenses and personal liability, which keeps you covered should you become ill or injured, or cause harm to anyone else whilst overseas.

Comprehensive policies will include additional cover for things like trip cancellation, family emergency and accidental death. If you have pre-paid flights, tours or accommodation where you have outlaid significant cash upfront, a comprehensive policy that includes cancellation cover is a wise choice as you'll be protected for any prepaid holiday expenses should something unforeseen stop you from taking your trip.

A mid-range or comprehensive policy will also provide cover for your personal belongings. If you're travelling with electronic devices such as laptops, cameras or smartphones, check out the 'per item' limits and add high-value items where appropriate.

2. Compare, compare, compare

Comparing policies is a great way to find the right travel insurance for your needs. All insurers offer different benefits and pricing, so once you’ve identified what level of cover you need, the next step is to start comparing policies to bag yourself a bargain. Reading up on real customer experiences is also a great way to see which insurers travellers recommend. Unsurprisingly, our travel insurance reviews often reveal a different tale to testimonials featured on the insurers’ site.

3. Cheapest is not always the best

One of the biggest mistakes travellers make is purchasing a policy based on the cheapest price. Selecting the cheapest might seem like a bargain, but it might mean you're missing out on some valuable cover. The key is to get the right level of cover at the best price.

4. Not all policies are created equal

When shopping around for travel insurance in Australia, you may notice that many different brands are underwritten by one of a few big insurers, such as Allianz Australia Insurance Limited, Chubb Insurance Australia Limited, Great Lakes, Lloyds of London, QBE Insurance Limited and others. Whilst they look similar at first glance, they will almost certainly not be the same. Each insurer negotiates a product policy and chooses what to include or exclude. So think about your trip and planned activities that you need cover for and pay attention to general exclusions.

5. Get the best bang for your buck

With so many travel insurers in the market, how do you really know who covers more than the other? The ideal policy is one that provides you with the cover you need, at the right price. Some insurers definitely do cover more than others, but why pay for cover that you don't need!?

Luckily, we've done the hard work for you. If you want to know who offers the best cover for expensive items, or who has the best single item limit - see who really covers more in our handy guide. Alternatively, if you're looking to compare travel insurance quotes fast, then use our quoting engine to compare travel insurance quotes now.

6. Read the print - small or not

Whilst it can be extremely boring, the fine print in any policy needs to be read and understood. Understanding the insurance exclusions and loopholes will help you to avoid or at least understand when you're placing yourself in a situation that your insurer will not cover.()

Which is the best travel insurance for Covid cover?

The best travel insurance is out there - all travellers have to do is have a clear understanding of what they need cover for and match this to the right provider. Some additional considerations when purchasing a policy are: Many travel insurance policies offer good medical coverage, but not all cover Covid-related problems. If that’s important to you, make sure to verify that the plan you’re buying specifically covers you in case you contract Covid.he insurer reputable? Speaking with a few travellers and reading travel insurance reviews by customers can often reveal a very different tale to testimonials featured on the insurers’ site. Make sure you review an insurer by seeing how they score for customer service, value for money and claims experience to help you pick the right cover for your trip. Do they have a well-known underwriter that will guarantee you'll get covered?

Compare the best travel Insurance

When searching for the maximum cover, it's a good idea to compare a few different companies to see which policy gives you the best bang for your buck! The table below shows the top cover levels of some of the best travel insurance companies in the market to give you an idea of what is available. To get a comprehensive travel quote specific to your trip, use the quote box at the top of the page.

| Insurer | Underwriter | Policy Name | Medical | Cancellation | Luggage | Buy Now |

|---|---|---|---|---|---|---|

|

|

HDI Global Specialty SE – Australia

|

Comprehensive

|

Unlimited

|

Unlimited

|

$15,000

|

|

|

|

Certain underwriters at Lloyd's

|

Comprehensive

|

Unlimited

|

Unlimited

|

$15,000

|

|

|

|

Mitsui Sumitomo Insurance Company Limited

|

Insure & Go Gold

|

Unlimited

|

Unlimited

|

$15,000

|

|

|

|

HDI Global Specialty SE – Australia

|

Comprehensive Cover

|

Unlimited

|

Unlimited

|

$5,000

|

|

|

|

Mitsui Sumitomo Insurance Company Limited

|

Top

|

Unlimited

|

$20,000

|

$7,500

|

|

|

|

HDI Global Specialty SE – Australia

|

Comprehensive

|

Unlimited

|

Unlimited

|

$7,500

|

|

|

|

Mitsui Sumitomo Insurance Company Limited

|

Gold Plus Cover

|

Unlimited

|

Unlimited

|

$10,000

|

|

|

|

Chubb Insurance Australia Limited

|

International Comprehensive

|

Unlimited

|

$10,000

|

$15,000

|

|

|

|

Allianz Australia Insurance Limited

|

Comprehensive Cover

|

Unlimited

|

Unlimited

|

$10,000

|

|

|

|

Allianz Australia Insurance Limited

|

Comprehensive Cover

|

Unlimited

|

Unlimited

|

$10,000

|

|

|

|

Zurich Australian Insurance Limited

|

Comprehensive

|

Unlimited

|

$10,000

|

$10,000

|

|

|

|

Zurich Australian Insurance Limited

|

Premium

|

Unlimited

|

Unlimited

|

$15,000

|

|

|

|

Zurich Australian Insurance Limited

|

Comprehensive Cover

|

Unlimited

|

Unlimited

|

$15,000

|

|

|

|

Zurich Australian Insurance Limited

|

Overseas Explorer

|

Unlimited

|

$5,000

|

$10,000

|

|

|

|

Certain underwriters at Lloyd's

|

GO Elite

|

Unlimited

|

$25,000

|

$10,000

|

|

|

|

Chase Underwriting Pty Ltd

|

Excel Plus

|

Unlimited

|

$10,000

|

$5,000

|

|

|

|

Guild Insurance Limited

|

Comprehensive

|

Unlimited

|

Unlimited

|

$25,000

|

|

|

|

Southern Cross Benefits Limited

|

Comprehensive

|

Unlimited

|

$2,500

|

$25,000

|

|

|

|

Pacific International Insurance Pty Ltd

|

The Works Plan

|

Unlimited

|

Unlimited

|

$12,000

|

|

|

|

Certain Underwriters at Lloyds

|

Comprehensive

|

Unlimited

|

$20,000

|

$20,000

|

|

|

|

Chase Underwriting Solutions Pty Ltd

|

Deluxe

|

Unlimited

|

$10,000

|

$7,500

|

|

|

|

Zurich Australian Insurance Limited

|

Comprehensive

|

Unlimited

|

Unlimited

|

$15,000

|

|

|

|

Pacific International Insurance Pty Ltd

|

Explorer

|

Unlimited

|

Unlimited

|

$10,000

|

|

|

|

Tokio Marine & Nichido Fire Insurance Co. Ltd

|

Top Cover

|

Unlimited

|

Unlimited

|

$15,000

|

|

|

|

Allianz Australia Insurance Limited

|

Comprehensive

|

Unlimited

|

Unlimited

|

$10,000

|

|

Please note, the table above shows the listed insurer's most comprehensive policy - international trips only The information provided is of a general nature only and does not take into account any particular personal objectives, financial situation or needs. Before making a decision you should consider the appropriateness of the information having regard to your personal objectives, needs and circumstances. Cover levels could change at any time.

What does Travel Insurance Cover?

24/7 Medical assistance

Yikes, your mozzie bite has got infected and your lower leg has started going green...what to do!? Go to a hospital and all your bills will be covered by travel insurance – that’s what! Travel insurance covers your medical expenses for injury or illness including hospital stays, surgery, dental, prescription drugs and doctor visits.

Cancellation Cover

Sometimes trips just don't go to plan! An accident before your holiday puts a spanner in the works, or a natural disaster puts a dampener on your dream location. Cancellation benefits cover the cost of rearranging or cancelling your trip due to a range of unforeseen circumstances.

Lost or Damaged Luggage

It's a real pain in the ar*e when your stuff is lost, stolen or doesn't show up. At least if disasters happen on your holiday your policy will replace or reimburse you for your baggage and personal items if they disappear or are damaged.

Travel Delays

You’re flights delayed, your train is late… but that doesn’t mean you should be out of pocket. If your transport is postponed due to an unforeseen reason, your out-of-pocket accommodation, meals, and transport costs would be covered until you get back on track.

Family Emergency

Going on holiday should be oh so much fun! But there can be apprehension when leaving loved ones behind. Have peace of mind knowing that if any family emergencies happen while you’re away you’re covered to get home and be by their side.

Personal Liability

A lawsuit would put a downer on your holiday. Relax as you're covered in the event that you are found to be legally liable for accidental injury or damage you may have caused to another person or their property whilst on your trip.

How do I choose high-quality travel insurance?

The best travel insurance is out there - all travellers have to do is have a clear understanding of what they need cover for and match this to the right provider. Some additional considerations when purchasing a policy are:

Is the insurer reputable? Speaking with a few travellers and reading travel insurance reviews by customers can often reveal a very different tale to testimonials featured on the insurers’ site. Make sure you review an insurer by seeing how they score for customer service, value for money and claims experience to help you pick the right cover for your trip. Do they have a well-known underwriter that will guarantee you'll get covered?

Do they offer emergency assistance? A 24-hour medical assistance hotline will be extremely useful to you if you are having troubles overseas. Most insurers offer worldwide helplines available 24 hours a day, 7 days a week.

What is the excess? The amount you pay in the event of a claim varies between insurers and may vary depending on the claim type. For instance, you may not have to pay an excess for medical claims but pay $200 for lost belongings claim. Make sure you’re comfortable with the excess amounts. You can often remove the excess by paying an additional fee around the $25 mark.

What are your preferences? Filter the things that matter most to you on your holiday. If you are not taking valuables you may not need any luggage cover. If you're two days out from your trip cancellation is less of a worry.

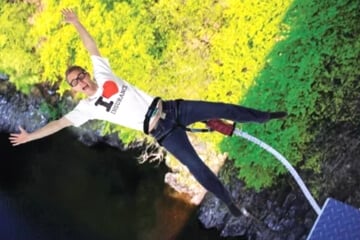

What are the exclusions? Even the best policy won't provide cover for everything. You should pay attention to your policy's exclusions before you set off. Typically you're not covered if you put yourself in danger (e.g. some high-risk activities like skydiving might not be covered); for any items that you leave unattended which are then lost or stolen; or for any medical conditions you had before you left for your trip.

Should I compare plans: Yes! It's important to make sure you're getting the best bang for your buck. Using a comparison site like ours helps you to compare features and benefits from a bunch of insurers in the market to help you get great cover for your holiday.

Always read the small print! From age restrictions to pre-existing illnesses; to unattended items, to ski cover. We could go on and on. When you buy a policy you must declare that you have read the information provided to you - so read it before you buy...Every time!

travel insurance faqs

Have questions on finding the best travel insurance? Here are answers to some of the most common queries we get from our customers.

The cover that is best suited to your trip depends entirely on you and your circumstances. If you're a backpacker on a strict budget, you might want a no-frills medical-only policy, while if you've paid a lot in deposits or if you have pre-existing health conditions, a more comprehensive policy might work for you. Create a quote to start comparing prices and features.

There are over a hundred different travel insurers in Australia, so we forgive you for feeling a little frazzled about your cover. A good way to wittle down your options is to read some reviews to find out what past customers are saying about their experiences. Then once you have a few brands in mind, compare some policies and see which ones give you the best bang for your buck.

Some policies have no age restrictions at all, others limit certain products (such as annual multi-trips) to those under 65 years. Generally speaking however you can find a comprehensive policy no matter your age, you just might have to pay a little extra for the privilege in your vintage years.

Comparing prices and features online makes it easier to find the policy that's right for you and your circumstances. With Comparetravelinsurance.com.au, the price you see is the price direct from the insurer. We compare heaps of policies for all types of travellers from some of Australia’s most reputable travel insurers. We compare 25+ insurance brands including 1Cover, Amex, Budget Direct, Insure and Go, Zoom & more!

Natalie Smith

Having travelled to over 40 countries, studied tourism management and worked as a flight attendant for over three years, Natalie knows more than a thing or two about travel! She’s an adventure-lover, whose favourite trips have been trekking Machu Picchu and volunteering in an animal shelter in the Amazon. Qualified in Tier 2 General Insurance General Advice and specialising in travel insurance for the last five years, she in passionate about helping travellers get the most out of their holiday.

trending tips and guides

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Comprehensive Travel Insurance

Comprehensive travel insurance is the highest level of cover you can buy. Learn more about what it covers

1Cover

1Cover Fast Cover

Fast Cover InsureandGo

InsureandGo Ski-Insurance

Ski-Insurance Tick Insurance

Tick Insurance Zoom Travel Insurance

Zoom Travel Insurance AllClear

AllClear Amex

Amex Australian Seniors

Australian Seniors Boomers

Boomers Budget Direct

Budget Direct Cover-More

Cover-More Easy Travel Insurance

Easy Travel Insurance Freely

Freely Go insurance

Go insurance Insure4Less

Insure4Less Passport Card

Passport Card SCTI

SCTI Travel Insurance Direct

Travel Insurance Direct Travel Insurance Saver

Travel Insurance Saver Travel Insuranz

Travel Insuranz Webjet

Webjet World Nomads

World Nomads World2Cover

World2Cover Worldcare

Worldcare