why aussies love compare travel insurance

No Hidden Fees

Travel agents and airlines charge huge commissions. We don’t! Our travel insurance comparison is free to use. You'll be directed to the insurer's website to buy travel insurance without any sneaky charges

On-board medical cover

Whether you're looking for cheap travel insurance or fully comprehensive cover for a domestic or international trip, you'll find the prices on our site are the same great prices you get buying travel insurance direct!

Data Protection

We promise to keep your data secure and not to sell your information to other companies. And we only ever send you relevant emails you have subscribed to.

Convenient

Using our comparison is easy-peasy! One simple form makes it quick and easy to compare travel insurance quotes for your holiday. You'll get quotes online for your trip in seconds.

Rest Assured

All the policies we compare have 24/7 overseas emergency assistance to help in time of need. All brands are underwritten by reputable insurers like HDI, Certain Underwriters at Lloyds & more!

Product Choice

We compare policies for all types of travellers. Whether you’re exploring the world on a shoestring budget or indulging in a once-in-a-lifetime luxury escape, we offer a wide range of options to consider.

travel insurance extraordinaire at your service

Need some help? Check out handy FAQS to help with all your curly travel insurance questions.

FAQswhy buy travel insurance?

We’re not silly, we know that plenty of Aussies go on holiday and have an amazing time exploring new and exciting places without buying travel insurance. But taking a gamble on your much-needed break can be risky. Here’s why!

Trust me, I'm

not crackers!

Exxy Medical Costs

If you buy a policy for just one reason, this is it! Falling ill or being injured while travelling overseas can be extremely costly. Hospital costs in the USA can reach up to $10,000 per day, while emergency transport home for treatment can easily exceed $100,000! Ouch!

Disasters Can Strike

The excitement of getting on that plane has you knotted up like a pretzel. Picture your dismay if you had to cancel last minute. Worse still, imagine you’re mid-martini when bad news breaks. Should you need to return home, you’ll be covered for unforeseen events like injury or illness of a close relative.

Your Stuff Is Important

Loss, theft or damage to your prized possessions can be a common, yet gut-wrenching experience. If your personal belongings go AWOL while you’re away the right policy will pay to replace or repair them. Win!

Peace Of Mind

Travel insurance comes with 24/7 emergency assistance services which includes a team of doctors, nurses, travel agents and translators ready to support you in your time of need. ...Aaaand relax.

Because You Have To

Still not convinced? We hate to be the fun police, but some countries simply won’t let you in without cover! For example, it is mandatory to take out travel insurance when travelling to Thailand or Cuba.

trending trip cover tips and guides

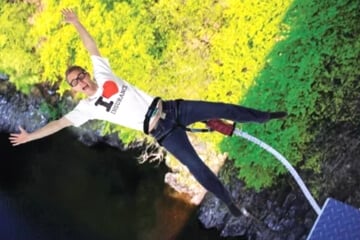

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Coronavirus, Travel Disruptions and Your Insurance

The rapid spread of covid-19 around the globe has thrown international travel into chaos. Find out what's covered if you're travelling during the coronavirus outbreak.

travel insurance review

Not sure which policy to pick? Our travel insurance reviews are here to help! Thousands of Aussies have reviewed their travel insurers to give you the inside story on everything from claims handling to customer experience. Or perhaps you want to have your say? Whether you love or loathe your travel insurer rate and review them to help other Aussies pick the right policy for their holiday.

travel insurance frequently asked questions

Have a travel insurance question? Here are some of the most common questions we get from our customers.

The best travel insurance depends entirely on your planned trip and your circumstances. If you're a backpacker on a strict budget, you might want a no-frills medical-only policy, while if you've paid a lot in deposits or if you have pre-existing health conditions, a more comprehensive policy might be best for you. While there's no single best travel insurance that's right for everyone, finding a policy that works for you is easy when you use our quote comparison to start comparing prices and features. With Compare Travel Insurance, you can also read up on travel insurance reviews from customers to learn about their customer service and importantly claims experience.

Comprehensive travel insurance includes coverage for unexpected medical expenses overseas in the event of injury or illness, as well as cover if your luggage is lost or stolen, cancellation and disruption benefits if you need to cancel or are delayed for unforeseen reasons, as well as public liability cover. Go to our comprehensive travel insurance guide to learn more.

Medical-only trip insurance a.k.a basic policies generally only offer coverage for unexpected medical expenses overseas. Some basic policies also include a small amount of coverage for luggage or cancellations. Our website allows you to filter quotes for basic, mid-range and comprehensive travel insurance policies and their features to help you find the policy which is right for you.

Although we recommend buying a policy as soon as you've started paying deposits for flights, accommodation and tours, you can buy travel insurance at any point, even if you are already overseas. Exclusions often apply though, so be sure to check the PDS before you buy.

Yes, you can. Generally speaking, you can purchase travel insurance up to a year before your trip, right up to boarding at the airport. With comprehensive travel insurance, you are covered for cancellation benefits from the moment you buy your policy, so we recommend buying it as soon as you start paying for flights, tours and accommodation.

You can buy cover if you are already overseas, although each travel insurer has different rules on age limits and waiting periods. Check out our already overseas travel insurance guide to learn more.

You can buy travel insurance to cover you when you're pregnant, but every brand has different rules depending on how many weeks gestation you are, whether you've had complications, and whether you're looking for cover in case of emergency birth. Check out the handy table on our pregnancy guide for more information.

If you're an Australian resident, a domestic policy covers you for cancellations, luggage cover and often rental vehicle excess, but as you're covered by Medicare, medical coverage is not included. International visitors to Australia are currently not required to have travel insurance by law, but it is highly recommended to protect you from eye-watering medical bills and more.

The cost of travel insurance depends on a range of factors including your destination, duration of travel, age of travellers, planned activities, whether or not you have any medical conditions and the type of cover you choose (medical only, mid-range or comprehensive). The cheapest travel insurance is generally to less risky parts of the world - places with cheaper healthcare and less risk of injury, illness or theft - and policies which offer less coverage - so ones without benefits for adventure activities or pre-existing conditions. To get cheap travel insurance from Australia for your trip, create a quote and compare prices, but remember that the cheapest isn't always the best. You should consider your trip and what you require cover for.

Comparing prices and features online makes it easier to find the policy that's right for you and your circumstances. With comparetravelinsurance.com.au, the price you see is the same price direct from the insurer. Sometimes you're not after the best policy but rather the best bang for your buck and comparing prices and features online can save you time, worry and loads of money.