Are you visiting Australia from overseas? Or do you live in Australia and need to arrange travel insurance for friends or family visiting you?

If that's you, you might be finding it tricky to find cover. To buy a standard comprehensive travel insurance policy, most insurers in Australia require you to be a resident to qualify for cover, but there are options out there for you!

What Are Visitors Options?

Visitors to Australia can either choose to buy a policy from within their own country or opt for Overseas Visitors Cover, which unfortunately only a handful of companies in Australia offer.

What Is Overseas Visitors Cover?

Overseas Visitors or Inbound policies generally are for those travellers coming to Australia on holiday (or business) who do not have travel cover from their home country.

While it is typical to purchase travel insurance from your home country before you depart, more and more travellers to Australia are taking out policies with Australian brands for their perceived reliability. With one in four Australians born overseas, and 46% of Aussies have at least one parent born overseas, increasingly these policies are bought by locals for friends and family visiting Australia.

What Are The Conditions of Inbound Travel Insurance?

- A visitors policy will typically cover your flight to Australia, the time while you are here, but cover will stop when you reach immigration at the airport when you are returning home

- Age restrictions may apply

- All or the majority of your trip must be within Australia to qualify for cover

- A waiting period may apply to medical claims

- Must purchase within a specified time frame of landing in Australia

- If you have Medicare, you may not be eligible for cover from some providers

Where Can You Buy Overseas Visitors Cover?

| Insurer | Underwriter | Policy type | Conditions | Buy Now |

|---|---|---|---|---|

|

|

Certain underwriters at Lloyd's

|

Comprehensive

|

Hold a valid Medicare card or are covered by an Australian private health insurance policy that satisfies the government health insurance requirements for your visa type

Have a home in Australia to which you intend to return

Your trip starts and ends in Australia

You hold a return ticket to Australia

|

|

|

|

Mitsui Sumitomo Insurance Company Limited

|

Insure & Go Gold

|

Non permanent residents who have a valid Medicare, private health fund or overseas student travel insurance in Australia

|

|

|

|

HDI Global Specialty SE – Australia

|

Comprehensive Cover

|

|

|

|

|

Mitsui Sumitomo Insurance Company Limited

|

Top

|

Non permanent residents who have a valid Medicare, private health fund or overseas student travel insurance in Australia

|

|

|

|

HDI Global Specialty SE – Australia

|

Comprehensive

|

Aged 74 and under

Hold a return ticket to Australia

Have a home in Australia which you intend to return to

Hold a valid visa or permit which provides access to all publicly funded health and disability services in Australia or you have private health insurance

|

|

|

|

Zurich Australian Insurance Limited

|

Comprehensive

|

You are a resident of Australia with a valid Australian Medicare card or currently

living in Australia with a visa allowing You to live, work or study in Australia and will

be returning Home at the completion of the Period of Insurance;

|

|

|

|

Zurich Australian Insurance Limited

|

Inbound Travel Insurance

|

You have a visa allowing you to live, work or study in Australia (or non-resident of Australia travelling on the inbound plan)

Will be returning home at the completion of the period of insurance

|

|

|

|

Zurich Australian Insurance Limited

|

Inbound Travel Plan

|

Hold a visa allowing you to live, work or study in Australia

|

|

|

|

Zurich Australian Insurance Limited

|

The Explorer

|

Australian visa that:

Authorises to live and work in Australia

Maintain a minimum level of health insurance coverage as required by the Department of Home Affairs

|

|

|

|

Certain underwriters at Lloyd's

|

GO Elite

|

Australian residents or non permanent residents of Australia aged 75 years or less who are already overseas at the time of purchase. If already overseas, You are an Australian resident if You satisfy the following conditions: i) You have a permanent residential address in Australia and will be returning to resume residency in Australia at the end of Your Trip; ii) Your period of overseas travel will not exceed 18 months in total from the date You originally departed Australia; iii) You have unrestricted right of entry into Australia; iv) You have access to long term medical care in Australia (excluding Reciprocal Health Agreements); v) You have a ticket booked for travel to Australia at the end of Your Trip; and vi) Both Your Trip and Period of Insurance will end in Australia on the same date.

|

|

|

|

Chase Underwriting Pty Ltd

|

Excel Plus

|

Non Australian citizens who have been resident in Australia for a period of not less than 3 months

|

|

|

|

Guild Insurance Limited

|

Comprehensive

|

Non-permanent residents who have a valid Medicare Card, Private Health Fund or Overseas Student Travel Insurance in Australia;

|

|

|

|

Southern Cross Benefits Limited

|

Comprehensive

|

Available to customers living in Australia permanently who are eligible to all publicly funded health and disability services.

|

|

|

|

Chase Underwriting Solutions Pty Ltd

|

Deluxe

|

Non Australian citizens who have been resident in Australia for a period of not less than 3 months

|

|

|

|

Zurich Australian Insurance Limited

|

Inbound plan

|

You are a resident of Australia with a valid Australian Medicare card or currently

living in Australia with a visa allowing You to live, work or study in Australia (or

non-resident of Australia travelling on the Inbound plan) and will be returning

Home at the completion of the Period of Insurance;

|

|

|

|

Tokio Marine & Nichido Fire Insurance Co. Ltd

|

Top Cover

|

Temporary residents between the ages of 18 and 75, provided:

You hold a current Australian visa (not a tourist, study or working holiday visa) that will remain valid beyond the

period of your return from your Trip

You hold a return ticket

You have a primary place of residence in Australia that you intend to return to

You purchase your policy before you begin your trip

Your trip begins and ends in Australia

|

|

|

|

Allianz Australia Insurance Limited

|

Comprehensive

|

Temporary residents between the ages of 18 and 75, provided:

You hold a current Australian visa (not a tourist, study or working holiday visa) that will remain valid beyond the

period of your return from your trip

You hold a return ticket

You have a primary place of residence in Australia that You intend to return to

You purchase your policy before you begin your trip

Your trip begins and ends in Australia

|

|

General Advice Warning: The contents of this article were accurate at the time of writing. Insurers change their policies from time to time, so some information may have changed. You should always read the Product Disclosure Statement of your chosen insurer to understand what is covered and what isn't. The information provided is of a general nature only and does not take into account any personal objectives, financial situation or needs. Before making a decision you should consider the appropriateness of the information having regard to your personal circumstances.

What’s Typically Included?

-

Medical cover within Australia: Medical expenses for injury or illness including hospital stays, surgery, dental, prescription drugs, doctor and dentist office visits. You will not be covered for medical treatment outside of Australia

-

Luggage and personal items: Loss, theft or damage to luggage and personal items

-

Personal liability: Cover in the event that you are found to be legally liable for accidental injury or damage you may have caused to another person or their property

-

Cancellation fees and lost deposits: The cost of rearranging or cancelling your trip because of unforeseen circumstances such as illness, accidents and extreme weather conditions

-

Rental vehicle excess: Cover for the excess payment on your rental vehicle’s insurance if the car you are driving is involved in an accident or is stolen

-

Hospital cash allowance: A daily allowance if you are hospitalised overseas (allowance will start after a specified period of time spent in hospital) Like any policy there are exclusions around pre-existing medical conditions and cancellation cover, so make sure you understand your cover by reading the Product Disclosure Statement before you buy.

Just After Medical Only Cover?

If you're finding it difficult to get travel insurance, but are mainly concerned about medical benefits, perhaps you'd consider overseas visitors health insurance cover instead? A few Australian health insurers (not travel insurers) offer cover to non-Australians, but remember these policies will not include any travel insurance benefits like cancellation, luggage, or personal liability benefits at all. Australian Unity, Bupa, HBF, HCF and Medibank all offer visitors health cover.

Do You Qualify For Medicare?

Some countries have reciprocal healthcare agreements with Australia such as; New Zealand, the United Kingdom, the Republic of Ireland, Sweden, the Netherlands, Finland, Italy, Belgium, Malta, Slovenia and Norway.

Lucky for you, if you're from one of these countries and you've got your Medicare card, you're covered for medical treatment you receive while you're here already.

Are You A Non-Resident Living In Australia For A Few Years?

If you're in Australia on a working holiday visa (417), a sponsorship visa (457), a de facto visa, or even a student visa you should look into non-permanent resident travel insurance rather than a visitors policy. Follow the link for more info.

Whether you're here for a quick visit, or an extended break, overseas visitors travel insurance cover is a vital part of every trip. Get cover today to ensure a smooth-sailing, stress free holiday!

Hayley Kennedy

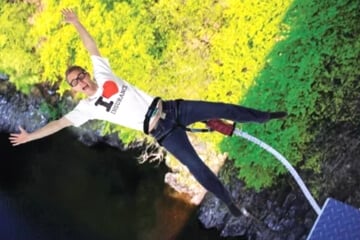

Originally from the UK, Hayley took a gap ‘year’ in 2011… and it’s still going! She’s travelled all over the world, volunteering in a Ugandan orphanage, skydiving in Australia, shark diving in South Africa, and skiing in the Alps (and snapping in a ligament in the process!). Certified in Tier 2 General Insurance General Advice and working in travel insurance for over two years, Hayley is a thrillseeker and a storyteller who loves hearing about customers’ holiday plans and sharing her own tips and must-see spots to help get them inspired.

trending tips and guides

Non-Resident Travel Insurance

Are you a non-resident living in Australia planning a trip overseas? If that's you and you're on a temporary visa, you can still get travel insurance for your overseas holiday, it just might be a little tricker to find!

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Fast Cover

Fast Cover InsureandGo

InsureandGo Ski-Insurance

Ski-Insurance Tick Insurance

Tick Insurance Zoom Travel Insurance

Zoom Travel Insurance Budget Direct

Budget Direct Cover-More

Cover-More Easy Travel Insurance

Easy Travel Insurance Freely

Freely Go insurance

Go insurance Insure4Less

Insure4Less Passport Card

Passport Card SCTI

SCTI Travel Insuranz

Travel Insuranz Webjet

Webjet World2Cover

World2Cover Worldcare

Worldcare