Comprehensive travel insurance is the highest level of cover you can buy. It typically includes cancellation cover, 24/7 medical cover, lost or damaged luggage costs, personal liability, family emergencies, additional cover for travel delays, and alternative transport expenses.

What is Comprehensive travel insurance?

Comprehensive travel insurance includes benefits for emergency medical coverage if you are injured or fall ill overseas, cancellation if your trip has to be cancelled, luggage cover if your baggage or personal effects are lost or stolen, and alternative travel expenses if your flights are delayed by bad weather. This is compared to basic or medical coverage, a more budget-conscious product which only covers medical expenses.

Compare Comprehensive Travel Insurance

When searching for the maximum cover, it's a good idea to compare a few different companies to see which policy gives you the best bang for your buck! To get a comprehensive quote specific to your trip, use the quote box at the top of the page.

What does Comprehensive Travel Insurance Cover?

24/7 Medical assistance

Don't fret should you get sick or injured on your trip, because this is exactly why you're buying protection for your holiday. Comprehensive travel insurance covers your medical expenses for injury or illness including hospital stays, surgery, dental, prescription drugs and doctor visits.

Cancellation Cover

Sometimes trips just don't go to plan! Cancellation benefits cover the cost of rearranging or cancelling your journey because of unforeseen circumstances such as illness, accidents and extreme weather conditions. Remember, cover starts from the day you buy your policy not when your trip starts.

Lost or damaged Luggage

It's a real pain in the ar*e when your stuff is lost, stolen or doesn't show up. At least if disasters happens on your holiday your policy will replace or reimbuirse you for your baggage and personal items if they disappear or are damaged.

Travel delays

Bummer, your flights were delayed, now what!? If your transport is postponed due to an unforeseen reason, your out-of-pocket accommodation, meals, and transport costs would be covered until you get back on track. Note, this benefit probably won't kick in if you only have a short delay which is less than 6 hours.

Family Emergency

It's always a worry going on holiday leaving loved ones behind. Never fear, should a close relative, or the person you’re travelling with becoming seriously ill, injured or heaven-forbid die, your travel expenses would be claimable. Restrictions can apply to relatives ages, medical conditions and where they live.

Personal Liability

A lawsuit would certainly put a dampener on your dream holiday. Relax as you're covered in the event that you are found to be legally liable for accidental injury or damage you may have caused to another person or their property whilst on your trip.

What Doesn't it Cover?

Let's face it, travel insurance can't cover everything! Just like waiting periods with your health insurance, or drink-driving exclusions with your car insurance, similar conditions apply to your travel protection. Here's a few things to be aware of that might not be covered.

Pre-existing illnesses: Some medical conditions that exist before you travel may not be covered. If you've recently been in hospital, have planned surgery, or suffering from a serious illness where overseas treatment is likely, you may find getting cover is tricker than usual. That's not to say if you do have a pre-existing condition you can't get cover at all, you may just need to have your condition assessed before cover can be granted. If cover is declined, in most cases, you can still buy a policy that would cover you for all other benefits, and for any unrelated illness or injury (just not your known pre-existing).

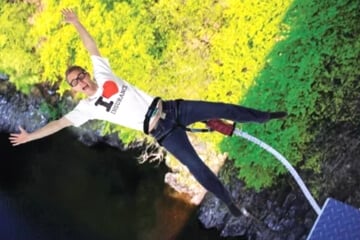

Being reckless: We know that travel is all about new and exciting experiences, but if you deliberately put your life in danger (like jumping off a high cliff into the sea) you wouldn't be covered. Injuries or loss when alcohol or drugs have been involved may not be covered either. Not too many piña coladas now!

High-risk activities: Hey there adrenaline junkie! Many high-risk activities and extreme sports (e.g. American football, boxing, skydiving, competitive cycling, rock climbing, polo and motorsports) are not covered. Always check whether your planned activities are before you go jumping out of a plane (for example.)

Travel supplier default: Does your tour operator sound a bit dodgy ? Travel insurance does not always cover for insolvency of travel agents, tour wholesalers, tour operators or booking agents. Make sure you’re confident in the operator making your travel arrangements.

Known events: Just like you can't buy car insurance after you've had a car accident, you are unable to buy travel insurance to cover an event that has already happened. For example, if news of a hurricane has already been spread all over the media and it prompts you to buy cover, it's already too late. You can of course still purchase, it's just that that particular known event is likely to be excluded from your cover.

And more... We haven't detailed all travel insurance exclusions here. Just the ones that tend to pop up. It's vital that you read your chosen insurer's Product Disclosure Statement before you purchase to understand the exclusions that apply to your cover. ()

Why you Need Comprehensive Cover

Exxy Medical Costs

If you buy a policy for just one reason this is it! Falling ill or being injured while travelling is not cheap! Hospital costs in the USA can reach up to $10,000 per day. If this alone doesn't convince you to buy cover for your trip, we don't know what will!

Disasters Can Strike

Picture your dismay if you had to cancel your dream va-cay last minute. Nightmare!! Worse still, imagine you’re mid-martini when bad news breaks. Should you need to return home, you’ll be covered for unforeseen events like injury or illness of a close relative.

Your stuff is important

Loss, theft or damage to your prized possessions can be a common, yet gut-wrenching experience. Don't worry, if your personal belongings go AWOL the right policy will pay to replace or repair them. Woop!

For your peace of mind

At the end of the day, your holiday is when you're meant to have some down-time! Comprehensive travel insurance will take a load off so you can get some well-deserved R&R.

Because You Have To

Still not convinced? We hate to be the fun police, but some countries simply won’t let you in without cover!

comprehensive travel insurance faqs

Which policy is best depends entirely on you and your circumstances. If you're a backpacker on a strict budget, you might want a no frills medical-only policy, while if you've paid a lot in deposits or if you have pre-existing health conditions, a more comprehensive policy might work for you. Create a quote to start comparing prices and features.

Some policies have no age restrictions at all, others limit certain products (such as annual multi-trips) to those under 65 years. Generally speaking however you can find a comprehensive policy no matter your age, you just might have to pay a little extra for the privilege in your vintage years. Use the quote box above to get a quote for your trip.

You can buy travel insurance to cover you when you're pregnant, but every brand has different rules depending on how many weeks gestation you are, whether you've had complications, and whether you're looking for cover in case of emergency birth. Check out the handy table on our pregnancy guide for more information.

It depends on your definition of ‘comprehensive’. Medical coverage is not included in domestic policies as that is covered by Medicare. However travellers can still face eye-watering bills from lost deposits, unforeseen cancellations and damaged personal items on trips within Australia too. Some domestic policies cover as much as Unlimited Cancellation benefits and over $15,000 for Luggage.

Insurers policies are all different. Some include cover for cruises automatically, others require the purchase of a cruise “add-on”. Get a cruise insurance quote to find out who covers what.

Comparing prices and features online makes it easier to find the policy that's right for you and your circumstances. With Comparetravelinsurance.com.au, the price you see is the price direct from the insurer.

Comprehensive travel insurance is the most popular kind of travel insurance. It covers a huge range of benefits including medical, cancellation, public liability and luggage cover. Some countries require you to have travel insurance to enter the country or get a visa, which other countries have exorbitant medical systems which leave you with eye-watering bills. That's where travel insurance comes in.

Comprehensive travel insurance covers cancellation, emergency medical, alternative transport expenses, luggage and personal effects that are lost or stolen, and public liability cover. This is opposed to basic or medical-only policies, which only cover your emergency medical expenses incurred overseas.

Natalie Smith

Having travelled to over 40 countries, studied tourism management and worked as a flight attendant for over three years, Natalie knows more than a thing or two about travel! She’s an adventure-lover, whose favourite trips have been trekking Machu Picchu and volunteering in an animal shelter in the Amazon. Qualified in Tier 2 General Insurance General Advice and specialising in travel insurance for the last five years, she in passionate about helping travellers get the most out of their holiday.

trending tips and guides

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Pregnancy Travel Insurance Guide

Not all insurers will cover you automatically if you’re over 22 weeks gestation or have had pregnancy complications. See which companies offer cover for pregnant women.