There are many ways you can buy travel insurance, including through travel agents such as Flight Centre and Hello World, but buying travel insurance direct from an insurer rather than through a third party can save you hundreds. You can easily avoid the hidden fees of travel agents by doing an online comparison and clicking through to purchase your travel insurance direct with your chosen insurer.

Australians often purchase their insurance via their travel or booking agent for convenience but you would be shocked to know the difference in cost.

Our investigations revealed that similar policies varied in price up to as much as $500 for a family of four travelling to Bali for 10 days. A policy with Flight Centre was $564, whereas a policy for the same trip with similar benefits from Budget Direct, 1Cover or Zoom Travel Insurance ranged from $65 to $100. When it comes to seniors with medical conditions, there were price variations as much as $1,000 once medical loadings had been added.

Purchasing travel insurance direct from a travel insurance company is usually substantially cheaper than purchasing through a travel agent or tour company as they have no 'middle man' commissions or fees to pay. These cost savings are passed on to you by way of offering quality, travel insurance direct.

Travellers can also expect to pay a higher premium for policies purchased with airlines. Some airlines suggest travel insurance as an add-on when booking flights online. Some are cheeky enough to pre-select travel insurance for you, so check the total summary as you may need to uncheck the travel insurance box.

Even among travel insurance providers, the rates and policy components can vary considerably, so it's a good idea not to just grab the first policy offered to you but to take time for a careful comparison. Online comparisons can't be beaten when it comes to the quickest and easiest way to compare direct travel insurance online. Start comparing travel insurance direct online now to see the savings for yourself.

Compare travel insurance direct policies.

When searching for the maximum cover, it's a good idea to compare a few different companies to see which policy gives you the best bang for your buck! To get a quote specific to your trip, use the quote box at the top of the page.

What the industry has been saying

The consumer advocacy group, Choice, estimated that agents received up to 50% of a policy premium in commission. "It's very easy and convenient to go with the insurance provided by the travel agent but that might not be the best deal," a Choice spokesman, Christopher Zinn, says. "Our advice is that substantial discounts can be found online and high agent mark-ups are often negotiable."

In advice supplied by insure4less.com.au, the company states: "Naturally, buying travel insurance direct and cutting out the travel agent or tour operator can bring the price down substantially, as these middlemen tend to earn high commissions."

Ian Jackson, the general manager of the online group, Travel Insurance Direct, says its policies carry lower commissions - less than 30 per cent - by cutting out some of the intermediaries (distributors, marketers or agents).

In addition, according to the Marketing Manager of direct insurance company 1cover.com.au: "Smaller travel agents may not always have back up in the event of bankruptcy, whereas all quality insurance companies in Australia are underwritten by a reputable insurance body."

Some travel insurers operate wholly online and are able to offer rates that are made cheap, when compared to traditional companies, due to reduced overheads yet they still maintain high value and reliability.

As NRMA Insurance advises: "Shop around – don't just accept the insurance that your travel agent or airline offers you, there may be cheaper options available which suits your needs."

Kate Smith from Zoom Travel Insurance commented: "Zoom believes that all Australians should be able to afford quality travel insurance. Why pay for a policy that covers you for a load of things you don't need. We keep our direct travel insurance prices low by offering flexible options that allow you to tailor your cover."

Expect better deals as competition heats up between travel agents, online and direct insurance retailers.

Travel insurance is one of those life decisions that can impact heavily if you don't put in the effort to make an informed decision. So take time to compare travel insurance direct versus travel agent prices.

If you're looking for information on Australian travel insurance provider travel insurance direct (TID), you can gain insights by reading customer reviews.

why buy travel insurance? compare travel insurance

24/7 Medical assistance

Don't fret should you get sick or injured on your trip, because this is exactly why you're buying protection for your holiday. Comprehensive travel insurance covers your medical expenses for injury or illness including hospital stays, surgery, dental, prescription drugs and doctor visits.

Cancellation Cover

Sometimes trips just don't go to plan! Cancellation benefits cover the cost of rearranging or cancelling your journey because of unforeseen circumstances such as illness, accidents and extreme weather conditions. Remember, cover starts from the day you buy your policy not when your trip starts.

Lost or damaged Luggage

It's a real pain in the ar*e when your stuff is lost, stolen or doesn't show up. At least if disasters happens on your holiday your policy will replace or reimbuirse you for your baggage and personal items if they disappear or are damaged.

Travel delays

Bummer, your flights were delayed, now what!? If your transport is postponed due to an unforeseen reason, your out-of-pocket accommodation, meals, and transport costs would be covered until you get back on track. Note, this benefit probably won't kick in if you only have a short delay which is less than 6 hours.

Family Emergency

It's always a worry going on holiday leaving loved ones behind. Never fear, should a close relative, or the person you’re travelling with becoming seriously ill, injured or heaven-forbid die, your travel expenses would be claimable. Restrictions can apply to relatives ages, medical conditions and where they live.

Personal Liability

A lawsuit would certainly put a dampener on your dream holiday. Relax as you're covered in the event that you are found to be legally liable for accidental injury or damage you may have caused to another person or their property whilst on your trip.

Eugene Wylde

Eugene is the king of insurance! Having spent more than ten years raising awareness on the importance of holiday protection, he is a self-confessed insurance geek extraordinaire when it comes to the world of travel cover. Eugene loves helping people save time, worry and loads of money with the right policy at the right price. His ideal holiday is any one where he has a pina colada in his hand. Salut!

trending tips and guides

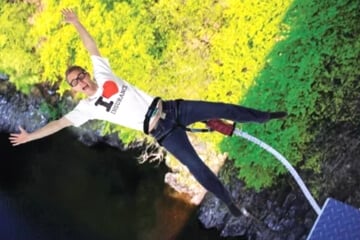

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Pregnancy Travel Insurance Guide

Not all insurers will cover you automatically if you’re over 22 weeks gestation or have had pregnancy complications. See which companies offer cover for pregnant women.