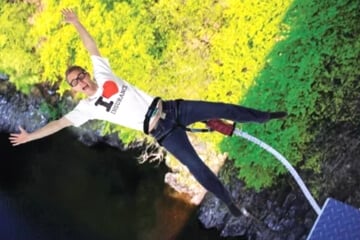

When you are on holiday far from home it’s important to know you're properly protected should things take a turn for the worst.

If you unexpectedly fall sick, become injured, or tragically die overseas, your policy can give you peace of mind knowing you’ll be covered you to bring you back home.

There are two types of repatriation cover to consider when purchasing a policy.

Medical repatriation covers you if you unexpectedly fall sick or become injured overseas and medical staff deem it necessary to bring you back to Australia. A lot of comprehensive policies include unlimited repatriation or medical evacuation cover in their policies. This also gives you access to specialist medical assistance teams around the world 24/7.

Repatriation of remains is when your body is brought back to Australia in the event of your death and/or cover for the cost of a funeral or cremation overseas. There are usually limits that apply to the repatriation of remains benefit. The following table details these.

How much does repatriation cost?

Flying a sick or injured person isn’t cheap! Depending on your condition you may be required to travel with medical equipment or a nurse to be by your side during transit. Or you may not be able to fly in Economy Class due to injuries. At any rate, medical evacuation costs can end up in the tens of thousands of dollars. Cost of repatriation by air ambulance from Bali can be upwards of $50k and Europe can be as much as $300k. If there is any reason to convince you why to get travel insurance, this is it.

What does repatriation benefits include?

- Helicopter evacuation: Had a slip on the slopes or need to be brought to shore quick-smart from your cruise? Your travel insurance will cover your medical transfer or evacuation transporting you to the nearest hospital for emergency medical treatment overseas

- Trained staff by your side: Arrangements to bring you back to Australia with appropriate medical supervision

- Hospital expenses: Guarantees of payment of reasonable expenses for emergency hospitalisation that may be required overseas

- Contacting your family: Passing on messages to your family or employer in the case of an emergency

- Bringing your loved ones to you: Arrangement for your dependants to return to Australia if they are left without supervision following your hospitalisation or evacuation

- Funeral or repatriation fees: An amount (usually around $15,000) for either a funeral cremation overseas and returning your remains to your home.

What's Isn't covered?

- Medical treatment costs once you are back in Australia: You will not be covered for hospital treatment back home as this is covered by the Australian government health system Medicare

- Advice that you decline: Your insurer is unlikely to cover you if you do not follow the advice from your medical practitioner

- Repatriation of remains to countries outside of Australia: In most policy documents it is stipulated that remains must be brought back to Australia or New Zealand

frequently asked questions faqs

Repatriation insurance typically covers you for emergency evacuation to get you home or to a hospital in the event of injury or illness, or the return of your remains to bring your body home in the event of your death.

You should never assume. Each insurer is different and cover will depend on the level that you purchase. It will usually be included as part of Emergency Medical Assistance benefits, or Medical Evacuation and Repatriation. It’s best to speak to your chosen insurer directly to see what they cover.

Yes, comprehensive travel insurance covers you from ship to shore. Should you need to be medically evacuated from a cruise ship days from shore your 24/7 emergency assistance team will work with the cruise line to find the best way to get you to a medical facility as quickly as possible. A cruise pack may need to be purchased to be adequately covered for cruise holidays.

Eugene Wylde

Eugene is the king of insurance! Having spent more than ten years raising awareness on the importance of holiday protection, he is a self-confessed insurance geek extraordinaire when it comes to the world of travel cover. Eugene loves helping people save time, worry and loads of money with the right policy at the right price. His ideal holiday is any one where he has a pina colada in his hand. Salut!

trending tips and guides

Cruise Insurance: The Ultimate Guide

Like any holiday, there are risks. With so much time spent on the water, and so much of your journey dependent on various port authorities, the only way to truly relax is to know you’re covered should something go wrong.

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Seniors Travel Insurance - The Ultimate Guide

One of the greatest things about getting older is the freedom to travel and explore new parts of the world. But before jet-setting across the globe to visit the grandkids or long lost friends, it is important to get the right travel insurance.