What’s up Jetsetters! Been high in the sky so much that you’ve earnt yourself a heap of frequent flyer points?

What happens if you pay for your flights using points and then you need to cancel your trip? Technically you’re not out of pocket, so can you claim on your travel insurance?

Whether you're tallking Velocity, One World, Qantas, Kris flyer or Emirate skywards, lucky for you a few Australian insurers have flapped their wings and said yes to covering your well earned points. They will pay the value of your reward points used to purchase an airline ticket, if you need to cancel due to unforeseen circumstances outside of your control.

When will travel insurance cover trip cancelation with points?

If you are unable to collect compensation from your airline, the following events would allow you to seek reimbursement from your travel insurance:

Trip cancellation due to:

- Severe illness: If a medical practitioner notifies that you are unfit to go on your trip

- Accident: Unexpected events such as a car accident on your way to the airport that stop you from travelling

- Family emergency: If you need to return home or cancel a trip because a family member is unwell or there has been a death to a close family member

- Natural disasters: Storms, hurricanes, earthquakes and all other severe weather conditions that affect your pre-paid travel arrangements

- Extreme events: Hijacking, riots and civil unrest that could alter pre-paid travel

When are you not covered?

Circumstances where you would not be liable for reimbursement include:

- Cancelled flights: Flights cancelled due to mechanical faults, overbooking, maintenance, repairs, rescheduling, service faults or the insolvency are not covered. It is the airline’s responsibility to compensate, reimburse, or find an alternative flight for the traveller – not the insurer

- Missed flights: If you turn up to check-in 30 minutes late and miss your flight your points won’t be redeeemable. Any delays because of your own negligence are not covered under travel insurance

- Change of mind: If you cancel your trip just because you decided not to go, travel insurance will not cover the cost

- Double reimbursement: If you are already due compensation from another source, travel insurance will not recover the lost points as well

How much will my travel insurance cover?

The terms around how much you’ll be reimbursed will vary from insurer to insurer. Typically you’ll receive the cost of an equivalent class airline ticket, based on the price at the time the original was purchased, less your financial contribution toward the airline ticket.

It is calculated by multiplying the total number of points lost, divided by the total number of points that were used to purchase the ticket.

Do airlines reimburse unused points if flights are cancelled?

Each airline will have different rules around their loyalty programs so your first point of call should be to always check with them first. Before you book your ticket, check your airline’s policy surrounding cancelling flights that have been purchased using rewards points.

You may not be liable for points reimbursment if:

- The flight was purchased on sale

- You are a low-level points collector

- You receive points through retail partners, not directly from the airline

- You have not opted to pay a refund fee at time of flight purchase

Check the small print

Don't just take our word for it! It’s vital that you check your chosen insurers Product Disclosure Statement in regards to cover for flights booked with frequent flyer points before purchasing your policy. Whilst it's amazing to be able to travel in a world using rewards, you may not always get the flexibility and protection needed for your overseas trip.

Natalie Smith

Having travelled to over 40 countries, studied tourism management and worked as a flight attendant for over three years, Natalie knows more than a thing or two about travel! She’s an adventure-lover, whose favourite trips have been trekking Machu Picchu and volunteering in an animal shelter in the Amazon. Qualified in Tier 2 General Insurance General Advice and specialising in travel insurance for the last five years, she in passionate about helping travellers get the most out of their holiday.

trending tips and guides

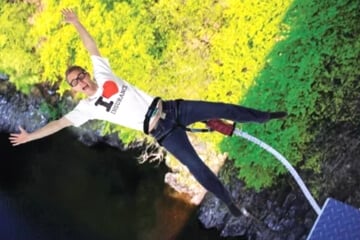

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Comprehensive Travel Insurance

Comprehensive travel insurance is the highest level of cover you can buy. Learn more about what it covers