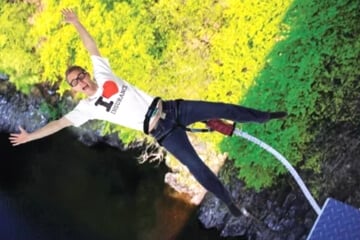

An adrenaline junkie's dream, Nepal lays claim to eight of the world's ten highest peaks. Whether you're there to trek the Himalayas, visit the golden temples, or see jungle wildlife there really is something for everyone at this must-see destination.

No matter which kind of Nepalese experience you're planning, neglecting travel insurance on your trip could be both hazardous to your health and your finances. Keep reading to find out what you need to consider when getting travel insurance for Nepal.

understand nepal travel insurance

Helicopter Rescue

When trekking in Nepal, you may find yourself in inaccessible locations. If you fall ill or get injured, you'll likely need a helicopter to get you down which isn't cheap. A helicopter evacuation in Nepal costs a minimum of $7,000.

Check Altitude Limits

You may only be covered to a specific altitude limit for trekking and hiking. The altitude restrictions vary between insurers, so be sure to check that you're covered for the heights you're planning to reach.

Adventure Activities

Some insurers automatically cover trekking under their policy as standard. Others may provide cover with a sports & adventure pack add-on. Check your activities are covered before you buy.

Location Exclusions

Although some insurers cover you up to 6,000m, some of these exclude travel to Nepal altogether. So if you're headed to Nepal, you'll need to go through the policy documentation carefully or contact the insurer directly if in doubt.

Other Terms

Each insurer has different terms and conditions when it comes to climbing equipment, using ropes and hiking with guides and whether or not you need to be with a licenced tour guide, so pay close attention to the details.

Cover your stuff

Loss or damage to your prized possessions can be a gut-wrenching experience whilst on an adventure. Make sure you find a policy that will adequately cover your hiking gear as some insurers don't cover equipment whilst in use

Natalie Smith

Having travelled to over 40 countries, studied tourism management and worked as a flight attendant for over three years, Natalie knows more than a thing or two about travel! She’s an adventure-lover, whose favourite trips have been trekking Machu Picchu and volunteering in an animal shelter in the Amazon. Qualified in Tier 2 General Insurance General Advice and specialising in travel insurance for the last five years, she in passionate about helping travellers get the most out of their holiday.

trending tips and guides

What Adventure Activities Are Covered?

Travel insurance is two words that could make all the difference to your holiday. Get the lowdown on how to choose the right travel insurance policy and the potential traps.

Pre-existing Medical Conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Ski Insurance Guide

The nature of a winter sports holiday is risky, so if you don't want to wipe out your savings with a fall on the slopes, get covered in snow!