Traveller caught red-handed by dodgy receipt

Not all roads lead to Rome, and not every receipt leads to a legitimate claim, say insurance experts at Comparetravelinsurance.com.au.

Earlier this year, a traveller claiming for thousands of dollars’ worth of electronic goods raised suspicions for a claims company linked to several leading Australian travel insurance brands.

A spokesperson for the claims team says that the customer’s story triggered questions from the start.

“We received a claim from a gentleman who had recently travelled to Uganda. He stated that he was on the street looking for his Uber when a man attempted to steal his phone out of his hand. The thief failed to get his hands on the phone but in this moment of temporary distraction, a second man entered the picture and successfully stole the insured’s bag containing his MacBook Pro and iPad Pro.”

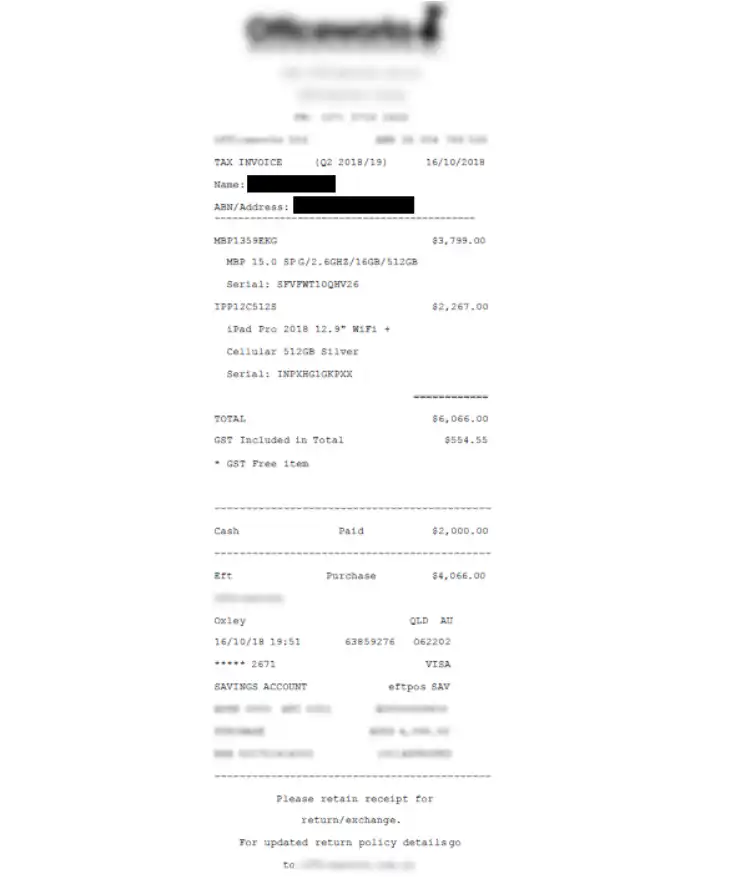

According to the customer’s receipt, the collective value of both stolen items came to $9,000. But according to the claim’s consultant, the receipt raised a few red flags.

“The receipt stated that the items were purchased from a well-known electronics store in Oxley, Queensland – a store some 20 kilometres from the customer’s home. While it’s no smoking gun, there are four branches of that same store located closer to the customer’s address which seemed a little suspicious. Still, if there was something underhanded going on here, we needed more information.”

More evidence came to light after the barcode on the receipt revealed inconsistencies. “In this case, the receipt brought up different sale items with the retail outlet than those listed on the receipt provided to us.”

“Once armed with this information, we were able to outline the discrepancies to the customer who went on to withdraw his claim, stating that local authorities in Uganda had miraculously managed to recover his items using CCTV.”

The claims consultant said that the case provides a perfect example of the sophistication and collaborative measures required when tackling fraud.

“Very often, fake receipts can look like the real thing. But through utilising our extended networks and resources, we can ultimately stop a fraudster in their tracks.”

Natalie Ball, director at Comparetravelinsurance.com.au, says that tackling fraud has become a major priority for the travel insurance industry.

“Fraudulent claims such as these result in honest policyholders having to pay higher prices. However, this year alone, we’ve seen huge advancements in fraud detection.”

Ball explains that technological improvements and analytic tools have allowed insurers to detect irregularities.

“Increased system automation that detects anomalous information and checks verifiable data, used in tandem with the knowledge of claims handlers and expert fraud investigators is aiding insurers to quickly identify fraudulent claims.”

Ball surmises that the next step is to shift public attitude.

“It’s all well and good identifying fraudsters, but there needs to be a shift towards the perception of insurance fraud being a victimless crime. Falsifying information to your travel insurer is an indictable offence. While prosecutions can be costly for companies, improved collaboration between insurers, retail outlets and the Insurance Fraud Bureau of Australia has been instrumental in reducing fraud. More action is being taken to stop fraudsters, whether they are one-off offenders or professional criminals.”

Natali Mansberg

Natali is a former kids magazine writer whose credits include working for the mouse (Mickey that is). An avid traveller, Natali spent part of her childhood in Israel and enjoyed several stints across the globe. Having worked in travel insurance for three years, Natali likes to simplify the fine-print and help Aussies make sense of their insurance policies. She currently lives in Sydney with her husband and one-year old son.

trending tips and guides

Travel Insurance Fraud 101

When it comes to fraudulent claims, travel insurers are no strangers. From telling tales, to exaggerations of the truth or just fabricated lies, insurers really have seen it all.

Travel Insurance

No matter if you're holidaying at home or taking an overseas vacation, our comparison helps you to compare quotes from some of Australia’s most reputable travel insurers.

Ultimate guide to travel insurance claims

We walk you through how a travel insurance claim works, what documents you might need, and how you can get your money back in your pocket sooner.