Please Note - If you are cruising around Australia you need to select Pacific.

With Regions, variances can apply for Bali, Indonesia, Japan and Middle East.

You are not required to enter stop-over countries if your stop-over is less than 48 hours.

Cheap Travel Insurance

When it comes to parting with our hard-earned dollars we'd all like to keep as much as possible. The good news is, we're here to help you find a low price policy that’ll leave you with more cash to splash on your holiday!

Don’t be a cheapskate

Travel can be an expensive experience, so don’t be a dope and leave home without protection. You can't put a price on your life, and safeguarding your travels doesn't have to cost the earth. Most Australians go out of their way to compare and find the best deals on airfares and accommodation so don't be tempted to skip the most important part of planning your trip – travel insurance.

We all want to bring home the bacon (or at least take it with us on holiday). But you’ll also want to board your flight with peace of mind, and that means packing the right cover. Cheap doesn’t mean nasty when it comes to travel insurance. Should the worst happen, not having cover can end up making a budget trip an extremely expensive one. The key to purchasing cheap travel insurance is to find quality cover at a price you can afford.

WHAT DOES BASIC TRAVEL INSURANCE COVER?

24/7 Medical assistance

Don't fret should you get sick or injured on your trip, because this is exactly why you're buying protection for your holiday. Cheap travel insurance covers your medical expenses for injury or illness including hospital stays, surgery, dental, prescription drugs and doctor visits.

Emergency evacuation

Should you find yourself injured and far from home, your travel insurance will cover you to get to medical attention as soon as possible. Relax knowing you'll be taken to hospital without a worry.

Personal liability

A lawsuit would certainly put a dampender on your dream holiday. Most low cost policies cover you in the event that you are found to be legally liable for accidental injury or damage you may have caused to another person or their property whilst on your trip.

Lost or damaged luggage

It's a real pain in the ar*e when your stuff is lost, stolen or doesn't show up. At least if disasters happens on your holiday your policy will replace or reimbuirse you for your baggage and personal items if they disappear or are damaged.

Travel expenses

Things happen on holiday. Know that for all those unexpected events you'll get cover for any additional expenses if you cannot travel because of an injury or sickness.

Peace of mind

Travel insurance will take a load off so you can get some R&R. Even a budget policy will cover you for an array of sticky situations while you're travelling within Australia, or overseas.

Compare cheap travel insurance

When searching for low cost cover, it's a good idea to compare a few different companies to see which policy gives you the best bang for your buck. The below table shows the basic cover levels of a few insurers in the market to give you an idea of what is available. To get a quote specific to your trip, use the quote box at the top of the page.

The information provided is of a general nature only and does not take into account any particular personal objectives, financial situation or needs. Before making a decision you should consider the appropriateness of the information having regard to your personal objectives, needs and circumstances. Cover levels could change at any time.

WHAT level of cover do i need?

Typically cover is broken down into three categories: Basic (or medical only), Standard (also known as Essentials) and Comprehensive. Or sometimes they’re known along the lines of Bronze, Silver, Gold and Platinum.

Budget Busting Basics

No frills travel insurance is nothing to sneeze at! A basic policy covers you for the most important thing on your holiday – your health. Aimed at the budget-conscious traveller, basic policies provide cover for the essentials such as:- 24/7 emergency assistance

- Overseas emergency medical and hospital expenses

- Personal Liability

- Some even offer cover for personal belongings and small amounts of luggage

Cover for the essentials and then some!

Standard travel insurance, or mid-range cover, is suited for the budget-conscious traveller who has prepaid flights and accommodation, or going overseas to stay with friends or relatives. It’ll cover you for all the essentials above, but with higher cover levels. You’ll also find some extra benefits such as:- Reimbursement for cancellation and lost deposits

- Travel delay expenses

- Loss of travel documents

- Travellers cheques

- Permanent disability

Hand The Keys To The Valet; You’ve Got Comprehensive Cover!

This is the Grand-Daddy of travel insurance. Comprehensive cover offers the highest level of protection, perfect for those seeking maximum peace of mind for their trip.Besides the essentials it can also include:

- Accidental death

- Car rental excess

- Domestic services or home help

- Financial default

- Resumption of journey

- Hijack and Kidnap

True Value: who offers the most cover at best price?

Yes, prices for travel insurance can vary enormously.

Say you’re 30 (ish) years old and you’re going on a single worldwide trip for two weeks, this is the price range you’re looking at:

Basic policies range anywhere from $53 – $70 usually including limited coverage for medical expenses and personal liability.

Mid-level policies range from $70 – $90 which typically cover medical, cancellation, personal liability, luggage, travel documents and travel expenses.

Comprehensive policies range from $90 – $320 which include all the bells and whistles as above, plus accidental death, hospital cash, personal disability, travel documents, travel expenses and way more!

You don’t have to have a Goldilocks moment to find the cover that’s just right. Comparetravelinsurance.com.au makes it easy as pie! (Or porridge as the case may be!)

travel insurance saving tips

Want to save mo money? Here are our quick and dirty tips when it comes to cheap travel insurance:

Increase your excess

Most insurers have a few different excess options you can choose between that let you lower your premium by opting to pay a higher excess.

Consider your habits

If you travel a few times a year, purchasing an annual multi-trip policy could save you big bucks!

Couple goals

If you’re travelling with family or a companion, a joint policy is often cheaper than purchasing cover separately. 10 or more travelling in the group? A group discount might be available and can save you some cash.

Compare & save

Use a comparison to compare key policy features from heaps of insurers so you get the right policy for your trip at the best price. Comparing online with us will give you the same competitive price as buying direct – but without the legwork of shopping around.

Consider the destination

Some insurers will ask you to nominate the region you’ll be spending most of your time, and other insurers will ask you to nominate the furthest region. Make savings by picking an insurer that favours the second option.

frequently asked questions

Is buying travel insurance direct cheaper?

It may come as a surprise to hear, but there can be a massive difference in the cost of your insurance depending on where you buy it from. Buying from a travel agent will often mean added costs and that’s less money for you to spend on your trip away! Purchasing travel insurance directly from a travel insurance company is usually cheaper because there are no 'middle man' fees attached. With comparetravelinsurance.com.au you can buy directly online without the hassle of schlepping yourself from provider to provider to compare costs– we’ve done all the work for you. Woohoo!

How do I find a cheap travel insurance policy?

The best way to find a cheap policy is to research your options. Work out how much cover you need to protect all your holiday expenses and work back from there. You may find that a basic, or standard policy may adequately cover your trip. The type of holiday you're taking can be a big factor in deciding how much cover you need. If you're lying on a beach reading a book, a basic policy might be just the ticket. However if you're trekking Kilimanjaro you might want to consider comprehensive cover.

What does cheap travel insurance cover?

Each policy is different, there's no denying that. Whilst some travellers are just looking for the cheapest policy money can buy, it's just smart to make sure you research your options before signing on the dotted line. Basic travel insurance policies, generally speaking, just cover medical benefits and personal liability.

How much does travel insurance cost?

How long is a piece of string! The cost of travel insurance will depend on where you're going, how long you're travelling for and your age. It can also increase in price if you're taking a cruise, have high value items or are doing some action-packed activities that you need extra cover for. Pre-existing illnesses that you declare and pay to cover can also increase the cost of cover. Travel Insurance policies usually come in three different tiers; depending on your trip and the level of cover you choose will also determine the price of your premium.

How do I get a discount?

If you’re already a member some insurers will offer you a loyalty discount. And it’s worth checking whether your employer has a group deal with an insurance company, as you may be entitled to a favourable rate through them.

Which insurers are the cheapest?

An easy way to find out which insurance policy is cheapest for your trip is to use a comparison site to compare a range of different insurance products and prices. You can sort travel insurance policies by price and see if they cover enough for your needs. A simple click of the mouse, from the comfort of your own lounge, and you’ll be comparing quotes quicker than you can say show me the money. Ka-ching!

OTHER HANDY Tips & Guides

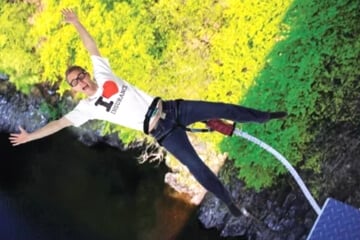

What activities are covered?

Are you a self-confessed adrenaline junkie? If you’re planning on doing some risky activities on your trip make sure you know if they’re covered, as not all of them are!

Pre-existing medical conditions

Having pre-existing medical conditions doesn't mean you can't get cover or that it has to be expensive. It simply means that you need to dig a little deeper when doing your research.

Backpacking traveller guide

It's no secret that backpackers are usually travelling on a shoestring budget, and often for an extended period of time. Find a policy without all the bells and whistles.

Natalie Smith

Having travelled to over 40 countries, studied tourism management and worked as a flight attendant for over three years, Natalie knows more than a thing or two about travel! She’s an adventure-lover, whose favourite trips have been trekking Machu Picchu and volunteering in an animal shelter in the Amazon. Qualified in Tier 2 General Insurance General Advice and specialising in travel insurance for the last five years, she in passionate about helping travellers get the most out of their holiday.

1Cover

1Cover  American Express

American Express Budget Direct

Budget Direct  Columbus Direct

Columbus Direct Downunder

Downunder  Fast Cover

Fast Cover  InsureandGo

InsureandGo  itrek

itrek  Tick

Tick Travel Insuranz

Travel Insuranz Travel Insurance Saver

Travel Insurance Saver Worldcare

Worldcare Webjet

Webjet Zoom Travel Insurance

Zoom Travel Insurance

BACK

BACK